The ideal Expense Textbooks of 2019

No matter your amount of financial commitment experience, these guides will help hone your investing capabilities. From housing expertise to millennial-targeted greatest techniques, these major-high quality titles go over all of it.

Protection Assessment to Buffett's essays have all had a tremendous affect on investing entire world and plenty of top rated hedge fund administrators today.

1. The Small E-book of Frequent Sense Investing by Man Spier

Getting The Best Investment Books To Work

The Very little Reserve of Common Sense Investing is a really perfect financial investment e-book for starting buyers, offering an available still sensible rationalization of your steps required to capitalize on the stock marketplace. Simple to study, this guide may be finished inside of numerous hours and provides instruction on staying away from typical pitfalls while turning into an efficient Trader.

The Very little Reserve of Common Sense Investing is a really perfect financial investment e-book for starting buyers, offering an available still sensible rationalization of your steps required to capitalize on the stock marketplace. Simple to study, this guide may be finished inside of numerous hours and provides instruction on staying away from typical pitfalls while turning into an efficient Trader.This investment e book addresses the basics of investing, for instance choosing an asset allocation and examining monetary statements of companies. Furthermore, audience are supplied with instruments for producing very long-term programs and setting real looking aims - it's over fifty,000 five-star assessments on Goodreads by yourself and is crucial studying for anybody desirous to enter the whole world of investing.

Prepared by the father of benefit investing, this vintage has withstood time and continues to be appropriate today. It outlines The true secret to thriving investing: obtaining fantastic providers at sensible prices. This book has experienced an huge affect on lots of excellent buyers including Warren Buffett. Also recommended by Invoice Ackman, Joel Greenblatt, John Griffin and Howard Marks.

10 Easy Facts About Best Investment Books Shown

This book emphasizes the worth of diversification within just an expenditure portfolio and exhibits audience how you can assemble 1 with small-Expense index resources. A must-examine for anyone wanting a bigger understanding of how stock marketplaces work and producing good investment decision selections.

This book emphasizes the worth of diversification within just an expenditure portfolio and exhibits audience how you can assemble 1 with small-Expense index resources. A must-examine for anyone wanting a bigger understanding of how stock marketplaces work and producing good investment decision selections.This e book is an ideal primer for starting traders mainly because it covers the fundamentals of investing, together with strategies to improve returns. On top of that, it clarifies dividend investing's benefits along with generating extensive-phrase financial commitment portfolios.

This reserve is definitely an indispensable go through For brand new traders, presenting a must have information about strategies that may be applied to improve returns and enhance benefits, such as diversification, cost cutting methods and cultivating the appropriate state of mind. In addition, this e-book also includes strategies to avoid issues which could transform highly-priced investments.

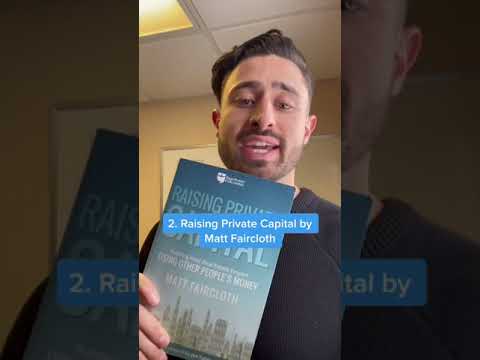

two. The Minor Guide of Value Investing by Person Spier

A reserve on investing really should deal with some standard ideas when presenting realistic tips that new investors can put into motion quickly. This ebook does just that by breaking down the sophisticated globe of private finance into workable items for beginners to grasp additional conveniently. Ranging from Principles like examining Internet really worth and building a company program before transferring on to Superior topics like retirement investing and faculty cost savings designs.

A necessity-study for virtually any new investor, this reserve gives an in-depth assessment of varied topics by having an simple-to-have an understanding of format. It points out how stocks perform, why you should invest in them and several lengthy-expression strategies for creating prosperity - no wonder some of the sector's finest investors including Warren Buffett and Monthly bill Gates hail this timeless classic as the greatest financial commitment guide ever published!

Benjamin Graham is widely acknowledged as one of many premier financial investment advisors ever, and his 1949 classic stays an priceless manual to newcomers on the inventory sector. Graham's philosophy of value investing protects traders from limited-expression fluctuations though providing lengthy-phrase wealth techniques determined by authentic returns.

This e book addresses an assortment of subject areas, starting from understanding inventory price and uncovering current market cycles, to finding out earlier current market heritage on the lookout for styles and traits and recognizing when it is acceptable to speculate or exit the inventory market place. No wonder lots of famed hedge fund administrators which include John Griffin and Charlie Munger propose it!

Peter Lynch realized a median yearly return of 29% on his Magellan Fund from 1977 to 1990, outperforming the S&P 500 Index eleven instances out of thirteen. This reserve delivers Perception into his good results, conveying how normal investors can conquer Wall Road specialists. A must browse for almost any novice Trader and any individual intrigued by how the wealthy bought so rich!

3. The Minimal E book of ladies’s Principles for Investing

The smart Trick of Best Investment Books That Nobody is Discussing

Investing is typically observed as being a male pursuit, but that does not signify Girls shouldn't take part. Published specifically for feminine investors, this 2019 e book serves as a comprehensive roadmap to getting started being an investor - from opening a brokerage account and comprehending investing Fundamental principles, as a result of guidelines for finding your very best investments, all to suggestions from the previous hedge fund manager who features Perception into navigating markets all through unstable durations - giving important assistance for newbies wanting to commence investing!

Investing is typically observed as being a male pursuit, but that does not signify Girls shouldn't take part. Published specifically for feminine investors, this 2019 e book serves as a comprehensive roadmap to getting started being an investor - from opening a brokerage account and comprehending investing Fundamental principles, as a result of guidelines for finding your very best investments, all to suggestions from the previous hedge fund manager who features Perception into navigating markets all through unstable durations - giving important assistance for newbies wanting to commence investing!Bogle simplifies investing for beginner have a peek at this web-site traders through her uncomplicated, logical variety of creating. Her reserve must be essential looking through for those wanting a further insight into how markets purpose.

This traditional book is ideal for rookie investors who're curious but unsure how the stock market place is effective. The author supplies vital concepts like compounding, diverse varieties of investing, inflation's effects on finances and the way to stay clear of common investing problems that plague novices.

A Random Stroll Down Wall Avenue was written in 1973 but is becoming a common investment go through considering that. This examine handles the history of stock markets along with a variety of financial investment strategies which have confirmed their really worth with time, the value of diversification, and the way to prevent popular investing pitfalls.

If you're seeking an investing ebook that is a snap to examine and entertaining, this just one may very well be exactly what you require. Making use of parables and tales to clarify simple ideas of investing, financial savings and wealth building - great for one sitting reading through! Additionally it does not become uninteresting immediately after only a website few paragraphs like other expense books could possibly.

Motive staying: You will discover a lot more complete expenditure guides that might make a greater place to begin. Continue to, this ebook remains a really perfect assortment for novice traders planning to know how markets functionality and take advantage of it for their reward - certainly Warren Buffett relied on this text when building his investing procedures! A necessity go through for anybody eager to broaden their awareness base on economical matters!

four. The Little Book of Widespread Perception Investing by Benjamin Graham

Investing publications give invaluable fiscal knowledge that could renovate you from a mean 9-5 staff into a wealthy millionaire. Top rated buyers are identified to examine numerous financial investment books annually so that you can stay up-to-date on recent information and facts concerning investing approaches, portfolio management and final decision earning.

Benjamin Graham's 1949 "the Father of Value Investing" e-book stays A vital examine for anybody click here aspiring to become an investor. The ebook delivers Necessities of buying straightforward to understand conditions that anyone can grasp; together with popular inventory market investments as well as their implications as well as diversification techniques. Furthermore, its advice assists identifie undervalued shares so you can also make seem investment conclusions when investing.

On the list of Leading financial commitment textbooks readily available, this textual content presents necessary steering for aspiring traders. It demonstrates how to produce sensible monetary conclusions that should raise wealth while preserving funds. In addition, its author features various techniques made to make investing successful when supporting an individual avoid faults created by other buyers.

This ebook needs to be demanded reading through for any really serious investor, providing obvious explanations of the fundamental rules of investing. Perfect for novices along with much more Highly developed ideas like tax procedures and index money - this critical reading through presents essential awareness in an uncertain time like COVID-19 epidemic.